Saturday 27 August 2022

Tuesday 10 January 2017

When A Central Bank Governor Speaks Like A Governor

1/3

Central Bank Road Map-2017, Free download pdf, from here>>>

https://issuu.com/m.r.mohamed/docs/cb-roadmap

More reading: http://www.dailymirror.lk/article/Central-Bank-unveils-monetary-and-financial-sector-policy-road-map-for-and-beyond-121676.html

Home Sri Lanka Think Tank-UK (Main Link)

2/3

3/3

When a Governor speaks frankly, the market responds positively

When a Governor of a central bank speaks like a Governor, he is sure

to receive two types of response. His candid speech will build private

citizens’ confidence in central bank actions which in turn helps the

Government in power to attain its growth objectives. But it could also

anger his political masters if they are just concerned with short-term

political gains and not about long-term sustainable economic

achievements.

Governor Coomaraswamy in the hot seat for being frank and candid

This is exactly what has happened to the Central Bank Governor Indrajit Coomaraswamy who had spoken

as the Governor of the Central Bank and not as a politician at the

launch of the Central Bank’s Road Map for 2017 a few days ago.

He was praised

by the private sector immediately as demonstrated by the supportive

press statement issued by the country’s leading business chamber, the

Ceylon Chamber of Commerce or CCC. Suspecting moves by the political

authority of the day to interfere with the free decision-making process

at the Central Bank, it has called the business community to support the

Bank’s independence. But Finance Minister Ravi Karunanayake is reported

to have expressed his anger at a subsequent media conference at certain

insinuations made by Governor Coomaraswamy during his speech.

Unsustainable budget deficits are the cause of macro ailments

Governor Coomaraswamy’s speech in question was candid, objective and

impassioned unlike the speeches made by his two immediate predecessors.

It did not contain political camouflage, painting a rosy picture about

the soundness of Sri Lanka’s economy. He said that Sri Lanka’s economy

was sick, in the hospital but fortunately not in the intensive care unit

or ICU. He did not blame only the present Government for the malady,

but made a general remark that it was all the previous governments that

had caused the economy to be hospitalised.

The Government’s policy action, he emphasised, should be proactive

and free from short-term political expedience. Drawing the attention of

his audience to the perennially worrying twin deficits – deficit on the

budget and the deficit on the trade account – which have made the

country’s macroeconomy unsustainable, Governor Coomaraswamy revealed a

fundamental economic truth as follows: “Unsustainable budget deficits

boost excess and untenable demand in the economy. When there is excess

demand, it leads to inflationary pressures and higher nominal interest

rates in the economy and there is also a higher propensity to import,

given the limitations in domestic supply. That in turn, exerts pressure

on the balance of payments and the exchange rate.”

Exchange rate depreciation cannot be prevented as long as the Government runs budget deficits

Consequently, the pressure for the exchange rate to depreciate cannot

be prevented only through traditional monetary policy. The culprit is,

therefore, the unsustainable budget deficits which the governments of

the past have been religiously following, sacrificing the long-term

sustainable development for short-term political expedience.

Economic reforms are a must

He thus emphasised that economic reforms are necessary but they

should be consistent, guided by commitment and focussed on clear

outcomes. What he meant by this is that reforms should not be selective,

abandoned midway and done half-heartedly.

The cause for the pressure for prices to go up and exchange rate to

depreciate had been the large fiscal deficits maintained by all

successive governments since independence. The end of the civil

conflict, according to Coomaraswamy, has created the best ground

conditions for Sri Lanka to move on to a higher growth path. The

responsibility of the Central Bank in this context has been to create

facilitating conditions for both the private sector and the government

sector to seize opportunities and elevate the economy to a high growth

path. The country’s sick economy cannot be cured overnight, according to

him, and it requires everyone concerned – citizens, politicians and

bureaucrats – to take pains.

There must be consensus among politicians and all other stakeholders

about the need for cohesive reforms aiming at improving productivity,

competitiveness and the business environment. He expressed the wish that

when the Government would restructure the Central Bank it would give

more powers to the Monetary Board implying that it should give a greater

independence to the Bank. According to Coomaraswamy, such moves “would

enhance the credibility of the central bank, while preserving the

independence it needs to play its roles efficiently”.

Both Governor Coomaraswamy and Minister Karunanayake are for disciplining the budget

Has Governor Coomaraswamy said anything that should anger Finance

Minister Karunanayake? No, because the Minister himself has admitted in

the past in his budget speeches as well as in public forums that there

is an urgent need for consolidating the budget.

One example is the keynote address delivered by him at the Economic

Summit organised by the Ceylon Chamber of Commerce in July 2016 in

Colombo. He reaffirmed his commitment to consolidate the Budget meaning a

number of reform measures being planned by the Government to discipline

the budget that has gone astray. Those measures include increasing the

revenue, reforming the tax structure, generating a surplus in the

current account of the budget now known as the revenue account, reducing

the budget deficit progressively and putting a check on the

unsustainable growth in public debt.

This summit, attended by President Maithripala Sirisena too, was

addressed by Governor Coomaraswamy also on the same line. Hence, this

writer, who was a panellist at the forum, praised both the Finance

Minister and the Governor for speaking the same language but warned that

what is being done by the Minister of Finance should not go against

what the Central Bank is doing. For instance, if the Central Bank has

adopted a tight monetary policy measure to prevent the economy from

getting overheated and thereby exploding eventually by way of

continuously rising prices, the Minister of Finance should not loosen

his budgetary expenditure programs by giving extra money to the hands of

people. It would result in an unwelcome consequence in which the

Central Bank would be forced to further tighten monetary policy to

arrest the situation. The ultimate result will be that the country would

get trapped in a vicious circle of ever increasing interest rates.

The reason for the dispute may be a power struggle

It, therefore, appears that the cause for the dispute has been that

the Minister wishes to control the Central Bank just like another

department of the Treasury and the Monetary Board led by Governor

Coomaraswamy has resisted that move.

This is not a salutary development since both the Minister of Finance

and the Central Bank should work together by coordinating the actions

which they plan to implement. The Minister should appreciate that an

independent central bank serves the Government better in its present

drive for joining the rich country club within a single generation, the

avowed goal of the present as well as the past governments.

Even a diehard socialist like Dr. N.M. Perera recognised this need

when he was the Finance Minister during 1970-75. Addressing senior

central bank officers in 1971, NM is reported to have said that the

central bank should submit its reports without political colours and he

would appreciate them only if they were dispassionate and objective. It

would certainly behove the Government led by a liberal like Prime

Minister Ranil Wickremesinghe to appreciate the wisdom so expressed by

this socialist Finance Minister.

Erosion of Central Bank independence by the previous government

However, the developments that have taken place since 2005 have been

to the contrary. The previous administration led by President Mahinda

Rajapaksa had compromised the Central Bank’s independence continuously

prompting the critics like Dr. Harsha de Silva, an independent economist

at that time and a Deputy Minister in the present Government, to blast

the Government and the central bank management.

Hence, when the new good governance Government was formed in 2015,

all the expectations were that it would respect the central bank’s

independence. In fact, the first economic policy statement delivered by

Prime Minister Ranil Wickremesinghe in Parliament in November 2015

promised this. But the subsequent actions of his Finance Minister were

to the contrary as highlighted by this writer in three previous articles

in this series.

The first attempt by Minister of Finance to compromise central bank independence

In the first article published in August 2016 under the title ‘Be Warned! Monetary Board is losing its power as well as its independence’,

this writer drew the attention of the Government to two unsavoury

measures which the Minister of Finance had proposed which fell within

the legitimate scope of the Central Bank.

One was the move by the Minister to introduce a national payments

gateway outside the Central Bank; the other was a proposal to form an

advisory group within the Ministry of Finance to address the solvency

issues of banking institutions. Both these functions have been handed to

the Central Bank by Parliament for valid reasons and the Minister of

Finance cannot encroach into them at his discretion.

Attempts in Budget 2017 to take over certain central bank functions

The second article published in November 2016

reviewed the budget 2017 presented by Minister of Finance to Parliament

and opined that the Budget was a forward measure if not for the

proposals by which he had attempted to acquire the legitimate functions

of the Central Bank.

There were seven such unsavoury interferences compromising the

independence of the Monetary Board proposed by him in the Budget as

described in the article under reference as follows:

“The Budget 2017 has also sought to encroach into the functions of

the Monetary Board of the Central Bank of Sri Lanka by proposing certain

proposals coming within the purview of the Monetary Board. This is

against the objective of creating the Monetary Board and the Central

Bank by Parliament in 1949. That objective was to allow an independent

Monetary Board to manage the country’s monetary and financial systems,

free from intervention of politicians or outside parties. These two

functions are too precious to be left to the politicians who have

personal agendas. Hence, the Monetary Law Act MLA made provisions to

safeguard the position of Monetary Board members; once appointed by the

President on the recommendation of the Minister of Finance and in

consultation with the Constitutional Council, they cannot be removed

while they hold office at the whims and fancies of the Minister of

Finance. If he desires to do so, there is a specific procedure

stipulated in MLA.

“Further, unlike the other public sector corporations and

institutions in Sri Lanka, the Monetary Board is the only entity to

which the Minister of Finance cannot issue general or specific

directions. However, if there is a dispute between Monetary Board and

the Minister with respect any particular desire of the latter, the

Minister could still have his say being carried out by the Board by

issuing a directive in writing to the Board in terms of section 162 of

MLA. But, when he issues this directive, he has to inform the Board that

the Government will take full responsibility of the consequences of

carrying out that directive. This provision was used only on one

occasion in Sri Lanka through the history of the Central Bank. That was

when Prime Minister Wijayananda Dahanayake issued a directive to the

Monetary Board to reduce interest rates in 1959 so that he could win the

forthcoming Parliamentary elections. In the subsequent election, the

Government took full responsibility for the consequences of reducing

interest rates, because his government was thrown out and he himself

lost his seat in Parliament. Hence, a Minister of Finance should not

take this golden provision in MLA lightly.”

All these functions had been assigned to the Central Bank by

Parliament by enacting special legislations and it was emphasised that

the Minister should not seek to take them away from the Central Bank

without going back to Parliament.

Civil society should help Central Bank to preserve its independence

The third article published in December 2016 under the title ‘ Reform the Central Bank but don’t erode its independence’

cautioned the Government that the way the Minister had proposed to

reform the Bank would result in eroding its independence, an objective

which the Prime Minister too had outlined previously when he presented

his first economic policy statement a year ago. But the Minister or the

Government does not appear to have taken these warnings seriously.

Hence, it is up to civil society now, as had been voiced by CCC in the

press statement quoted above, to come forward to defend the Central

Bank. The Monetary Board or the Governor alone cannot do that job

without such support.

Expressing professional views is not a sin

Governor Coomaraswamy cannot be faulted for expressing his

professional views on the economy candidly and frankly. The Government

led by Prime Minister Ranil Wickremesinghe will benefit immensely if it

has the patience and wisdom to listen to this professional. (W.A. Wijewardena)

Central Bank Road Map-2017, Free download pdf, from here>>>

https://issuu.com/m.r.mohamed/docs/cb-roadmap

More reading: http://www.dailymirror.lk/article/Central-Bank-unveils-monetary-and-financial-sector-policy-road-map-for-and-beyond-121676.html

Home Sri Lanka Think Tank-UK (Main Link)

Thursday 27 October 2016

Economic Statement of Ranil Wickremesinghe

With regard to the current state of the economy and the Way Ahead, I would like to recall the speech I made in the House on the 05th of November 2015.

We can once again become the resplendent nation we were under

Manawamma and Parakramabahu. But it is a path that must be pursued with

determination, commitment and patience. Only then can we create the

country that we can confidently pass on to the future generations.

At the time I made the statement last year, I affirmed that our

collective economic journey requires revolutionary thinking, bold

policies and initiatives that would transform Sri Lanka into a vibrant

and prosperous nation. The National Government started work on a sound

footing – by increasing the actual wages of the public sector including

those of general workers. This process stimulated domestic demand and

addressed the imbalance in income levels, the economic legacy inherited

from the previous regime.

However, we acknowledge that much more needs to be done. We aim to

enhance the income potential of Sri Lankans on a faster trajectory.

During the last 60 years, Sri Lanka has not kept pace with the

South-east Asian nations and has been only barely ahead of our South

Asian neighbours. Doubling our current level of per capita national

income from USD 4000 to USD is no magic trick – rather, it is setting in

motion a planned effort to grow at a faster rate. If we continue to

grow at our current rate of 5% per annum we will only double our

personal income levels by 2033.

We can double our personal income levels by 2025 if we set in motion a

growth rate of 7% per annum. This rate was achieved in the aftermath of

the war in 2009 but the momentum brought on as a dividend of peace did

not last.

In 2012, it went down below 5% per annum. Private businesses were

nationalised while local and foreign investment dried up. Heavy state

borrowing for economically non-viable state sponsored projects did not

leave any funds for private investors to borrow from the banks.

In 2015, we have addressed the inequality in income distribution at a

national level. Consequently, we have been able to uplift the income

levels of low income earners and public officials. At the same time, tax

levies are being imposed on affluent groups to fund higher wages and

minimize government borrowing.

Along with The IMF, The World Bank and The Asian Development Bank,

lending institutions of the US, Europe and Japan have expressed their

willingness to lend Sri Lanka funds at considerably low rates of

interest ; these funds would enhance and strengthen the economy. The

last time such funds were made available was between 2001- 2004, when I

was the Prime Minister. Today,

President Maithripala Sirisena and I have been able to successfully revive such funding sources towards assisting Sri Lanka.

For centuries, Sri Lanka’s location in the heart of the Indian Ocean

between Western and Eastern Asia has made us active partners of

inter-regional trade. The strategic importance of Sri Lanka as an Indian

Ocean hub in the realm of global logistics and commercial activities

has been widely acknowledged.

In this context, the foundation for a more sustainable economic model

has been laid already, enabling us to recover from the inward looking

economic policies of the past. Our exports with a value of USD 11

billion are contracting while garment exports remain static at USD 5

billion per annum. The garment industry will see a revival when GSP+

returns – we have already set in motion the process towards it being

obtained once again.

Agricultural exports have declined as a result of prices for tea and

rubber slowing down. It must be noted that in the plantations sector,

some of the companies are being run well while others not so.

The Government plans to restructure the regional plantations

companies by infusing new capital and introducing efficient enterprises.

Our export base has remained the same for over 30 years and is

dependant on a narrow export base of garments, tea, rubber, gemstones

and tourism. The economy cannot experience growth based on such limited

exports.

A key economic contribution in the form of remittances from the

Middle East remain volatile as oil prices fall and countries like Saudi

Arabia are reducing the salaries of their own citizens. This will pose a

new challenge to Sri Lankans employed in the Middle East.

As the global economy struggles to recover, Sri Lanka has been able

to successfully navigate amidst changing economic dynamics, maintaining a

prudent domestic economic level of growth.

The Government has encouraged the people living abroad and in Sri

Lanka to invest in construction, which has resulted in a construction

boom.

Sri Lanka is seeing a staggering growth in tourist arrivals as our

image as a safe and a friendly tourist destination is growing rapidly.

In the aftermath of a decade of neglecting markets, major international

airlines and hotel chains are once more entering a vibrant Sri Lankan

market.

We are now ready to enter the next and the most important phase of

economic activity, that of creating new and productive jobs and

livelihood for the young people. The creation of 1 million jobs will

empower the youth and enhance their standard of living.

We need to sustain a higher rate of growth for the plans to succeed ,

one that will result in higher exports and a greater domestic demand.

Such growth will also increase state revenue. As I mentioned last year, a

drop in government revenue and an increase in commercial debt to its

upper limits can have a drag effect on the economic development.

Achieving a high level of growth in exports need major capital

infusion and greater investments. New technological innovations, better

management of data systems and up-to-date market information systems are

needed to achieve better results.

During the Eighties, having decided that outsourcing was a better

option, Japan was reviewing moving operations to Thailand and Sri Lanka.

The Japanese delegation to Sri Lanka arrived at the height of July 1983

riots and needless to say, we lost the opportunity to Thailand which

obtained investments to the value of 50 Billion USD. There was a

spillover of US Dollars 13 Billion into Malaysia as well.

As the then Minister of Industries I focused on promoting

industrialisation. At the time, Vietnam has opened up as a market

economy model and came to Sri Lanka for advise. Unfortunately, as the

war progressed, we stopped pursuing industrialisation in 1997. Vietnam

continued to engage in industrialisation.

Sri Lanka’s total export stood at US Dollars 1.9 Billion in 1990.

Vietnam’s exports were worth US Dollars 2.4 Billion. Today, 25 years

later, Sri Lankan exports have climbed to US Dollars 10 Billion while

Vietnam retains exports valued at US Dollars 162 Billion, most of it

based on manufacturing.

In 2003, as the then Prime Minister, I set in motion the application

process for GSP+ , subsequently concluded by President Chandrika

Kumaratunga. While Bangladesh also enjoyed concessional entry into the

EU markets, Sri Lanka lost the GSP+ incentive in 2010.

In 2003, the Textile and Garment sector in Sri Lanka stood at US

Dollars 2.5 Billion, while in Bangladesh, it was US Dollars 5.2 billion.

Last year our exports went up to US Dollars 4.8 Billion while

Bangladesh stood at US Dollars 26.6 Billion.

We must understand that in order to grow out of being a poor,

backward country, we need to focus on large scale FDIs and accelerate

growth.

Towards this direction, the Government plans to create a positive

investment climate that will generate jobs. Hurdles that stand in the

way of achieving growth for business start-ups will be removed. The

processes of starting a business, getting construction permits,

electricity connections and bank credit, registering property,

protecting minority investors, the payment of taxes, trading across

borders, the enforcement of contracts, the resolution of insolvency, and

regulations governing labour market will be efficient mechanisms that

will facilitate business growth. Additionally, the Government will also

prepare legislations to establish a single window for investment

approval. Further, we will hold discussions with the Trade Unions and

relevant stakeholders. The targeted outcome is to bring Sri Lanka within

the top 70 nations of the Doing Business Index by 2020.

We plan to build on these strengths and initiate plans for a

logistical and business centre in the Indian Ocean. With this in mind,

we have started developmental work on 3 international ports and

airports, providing efficient connectivity within the region.

A new set of investment incentives based on Capital Allowances and

low tax regime will be introduced; the details will be announced in the

Budget

We plan to repeal The Export and Import Control Act and bring in new

legislation on the lines of Singapore’s (a) Regulation of Imports and

Exports Act and (b) Strategic Goods Control Act.

Current domestic market enterprises also have a greater role to strengthen the economy – in addition to expected Direct Investments of local and foreign origin. They too can add to export volume.

Current domestic market enterprises also have a greater role to strengthen the economy – in addition to expected Direct Investments of local and foreign origin. They too can add to export volume.

The Government will assist them to connect to the Global Value Chain

by introducing a Trade Adjustment Package which will include Capital

Allowance for new equipment.

Concurrently, we are reviewing the growing interest of local and

foreign business concerns towards solving the twin problems of low

private investment and the accumulation of vast debts by the Government.

As you are aware, during the last year, HE the President Maithripala

Sirisena and I have travelled to key destinations with an objective of

reviving the interest in Sri Lanka. We have met with success.

During my recent visit to Brussels, the officials of the European

Commission expressed their confidence that the GSP Plus trade concession

would be given favourable consideration. The Japanese Prime Minister

has also appointed a senior official to especially coordinate Japanese

Sri Lanka Joint Comprehensive Partnership Programme.

Towards creating newer markets for our exports, we are also

negotiating three trade agreements; ETCA with India, and two FTAs with

China and Singapore.

These are significant developments even as these two large economic

regions struggle to maintain economic momentum in their domestic

markets, which have been traditional export destinations for our

businesses.

Most of us thought that our next generations would have to pay the

debts incurred for Hambantota port and Mattala airport. Now, we have

entered into a debt to equity swap. Chinese investors have made

significant commitments to invest equity in the debt strapped Hambantota

Port and the Mattala Airport as PPP ventures.

The Government plans to receive sufficient funds to offset these

debts. You can now be assured that your children will not have to pay

these debts but can reap the benefits of a dynamic, international

air-sea hub.

Strong interest in utilizing these zones along with other such zones

in the western province have been noted by investors from China, Korea

and Japan. They plan to create an export market focused on Europe,

China, Japan and USA and the crescent of markets around the Indian

Ocean. Between the Middle East, Iran, Afghanistan, Pakistan, India,

Bangladesh, Myanmar, Thailand, Malaysia, Singapore and Indonesia there

exists a fast-growing population currently of over 2 billion people.

This combined market has the potential of 3 billion consumers by 2050.

Going forward, our development strategy will be aimed at capturing

trading opportunities within these identified Indian Ocean markets via

pursuing trade liberalisation agreements with their governments.

Concurrently, we are focusing on defining the two development corridors

across the country – this will be a focal area for investment by the

public and the private sector.

The logistical and infrastructural facilities that provide faster,

secure links to the global value chain empowering viable business

ventures, will be spearheaded for the first time in Sri Lanka, in these

development corridors.

The two development corridors will correspond to the two distinct

halves of the country irrigated by the two monsoons. The South-Western

corridor will have as its major axis the proposed Kandy-Colombo highway

linked to the existing Southern highway. This region has the strongest

potential to link up with global value chains, because of its close

proximity to the Katunayake airport and the Colombo harbour. This

project envisages creating a Megapolis Development Authority to develop

the entirety of the Western Megapolis an urban area of over 8 ½ million

people.

A brand new financial city centre that will be based at the new

reclaimed land development project alongside the Port of Colombo.

A sub-corridor that will stretch along the central highlands from

Kandy via Nuwara Eliya to Badulla and linked to the Kandy-Colombo

highway. This will connect the revitalized plantations economy and

modernized agricultural pursuits and will also lay emphasis on tourism

and service delivery initiatives.

The second North-Eastern development corridor will connect the

Eastern Province and the North Central Province to Jaffna linking the

Trincomalee Port City to the Rajarata. The completion of the

Moragahakanda and the Malwatu Oya reservoirs will create new vistas for

the country and will result in the region gaining more land for

agriculture. It will further result in the historic cities of

Polonnaruwa and Anuradhapura emerging as modern urban centres.

Trincomalee will be urbanized and transformed into a world-class Port

City.

Reconstruction of housing and civic infrastructure will be given

highest priority within the previously war-affected areas around Jaffna,

Mullaitivu and Kilinochchi.

SUSTAINABLE DEVELOPMENT

While the priority remains economic stimulation and the improvement

of individual finances, the plan also focuses on establishing a society

in which every citizen has access to equal opportunities and individual

rights are safeguarded – this includes the right to shelter. The Rural

Housing Loan Programme, Urban Regeneration Housing Programme, Estate

Housing Programme and Resettlement Programme are being implemented with

focus on vulnerable groups. Plans are underway to construct 500,000

housing facilities for the middle-class to meet the rising demand for

housing in urban and suburban areas, 65,000 houses for the urban

underserved population, 65,000 houses for internally-displaced people in

areas previously affected by conflict, and to fulfill 65% of the estate

housing requirement by 2020.

I must emphasise at this juncture that we are committed to the

sustainable development goals adopted by the UN General Assembly in

September 2015. Our development of industry, services and agriculture

will be guided by these principles. For instance, when we develop 15,000

acres of free trade zones in the South, we will undertake reforestation

of unutilised lands in other parts of the country. Similarly, we are

finding solutions to the overwhelming problem of solid waste disposal in

our major cities. This is a hazardous situation affecting the lives of

thousands of people , one left unchecked by the last government.

We are going ahead with schemes that provide safe drinking water to

the communities in need of such projects around the island ; we are also

seeking to improve treatment of waste water. The pristine status of our

natural environment remains our most precious resource and has been

praised by visitors throughout the centuries. We pledge to take utmost

care to preserve our natural resources and our heritage within all our

development efforts. The economic vision of the National Government will

yield prosperity for all Sri Lankans. It is an economy that will share

the benefits of development among all. One that will be friendly to all,

beneficial to all, keeping its focus on including sustainable

development as well.

What we are hoping for is a lawful economic environment that will set

the stage for sustainable development. We will incorporate a

sustainable development entity that will provide the necessary framework

and initiate mechanisms required. I called this the third generation of

economic reforms. The first generation was introduced by President

Jayewardene, the second by President Premadasa. What is now envisioned

by us here, is based on multifaceted economic linkages to global supply

chains and the planned increase in trade development. Many qualified

people prefer well-paying jobs that are given based on professional

capabilities. It is not viable to maintain a low paying production based

economy.

These developments will result in the creation of one million jobs

and the expansion of the middle-class; a nation in which the farmers

prosper and every child has access to education. Our end goal is

prosperity for everyone. Every citizen must enjoy the benefits of living

in a wealthier nation. This also includes the realization of the basic

rights of every citizen – principally, housing. We view this as the

first step towards ensuring total social inclusion, followed by measures

to promote inclusive involvement in the economy, especially for women,

while improving facilities for differently-abled persons to integrate

into society and pursue their life goals with normalcy.

BUSINESS AND SECTORIAL PRIORITIES

Sri Lanka has evolved a variety of distinct economic sectors, which

are capable of further integrating the country’s economy into the Global

Value Chain. The digital economy, tourism and commercial agriculture

are coming of age concerning their potential to offer high-value skills

and remuneration to young job seekers in the country. With the new

economic orientation that will include fewer opportunities with the

government and more exposure and opportunities for entrepreneurs and

skilled professionals, we aim to accelerate the broad basing of

opportunities in these segments – the digital economy, tourism and

commercial agriculture.

THE DIGITAL ECONOMY

The digital economy will empower our nation – through providing

affordable and secure Internet connectivity to every citizen in any part

of Sri Lanka, removing barriers for cross-border international trade. A

platform for cashless payments will also be created. Digital technology

will be included as a new subject in the school curriculum. We plan to

foster entrepreneurship opportunities in digital commerce while

providing training in cyber security monitoring and response.

MODERN MANUFACTURING ECONOMY

We shall strive to attain the status of a modern manufacturing economy that will include state-of-the-art equipment.

We plan to overcome the bottleneck of being a middle-income country

with low wages in our pursuit towards greater prosperity for our people.

STATE-OWNED ENTERPRISE (SOE) REFORMS

We will establish a Public Commercial Enterprise Board by law an

organization that will manage SOEs enabling them to be more efficiently

run on a commercial basis ensuring value for money. We are creating a

Public Wealth Trust through which the shares in state-owned entrepreneur

enterprises will be held in trust for the people.

FINANCIAL INCLUSION

With the passage of the Microfinance legislation in Parliament early

this year, rural microfinance is now a legitimate activity. Urgent

measures are being undertaken to link foreign microfinance providers

with local communities to promote greater credit penetration in rural

areas. The Ministry has already allocated five billion Rupees for a

special SME financing scheme to empower business formation and

development. A National Financial Inclusion Policy will be evolved by

the Central Bank to set quantitative targets for opening of accounts,

disbursement of SME loans etc. To enable this, we will be consolidating

rural development banks (RDBs). Rural Development Banks have become the

main channel for concessional lending to Small and Medium Enterprises.

Their decentralized management structure is reinforced with the Central

Bank of Sri Lanka, through its newly created regional departments. We

seek to initiate a nationwide campaign to encourage banking and endow a

spirit of entrepreneurship among all.

TOURISM

The plan to make Sri Lanka a high value destination is on the cards.

It will herald in prosperity that will showcase our cultural pursuits,

wild life and the environment via provinces developed as unique tourist

hot spots. We believe that Sri Lanka will be one of the finest travel

experiences for the global traveller.

MODERNIZING AGRICULTURE AND FISHERIES

It takes over a decade to modernize the sectors of agriculture and

fisheries. We plan to establish a Rural Modernization Board, which will

include all stakeholders. Fisheries and Poultry will be the first

categories to be promoted for exports.

The difficulties faced in the tea and rubber industry will be

reviewed. The Government will restructure the plantations sector to

invite new capital and eliminate inefficiency.

NATIONAL AGRICULTURAL MARKETING AUTHORITY

Marketing of agricultural products is the most important link between

the producer and consumers. We will establish a fully empowered

National Agricultural Marketing Authority to coordinate the marketing of

agricultural products, and develop existing markets, transport and

storage facilities. In addition, new infrastructure facilities such as

cool storage will be added at a divisional and regional level, for

preservation of food before or after purchase. Providing large storage

facilities for purchasing and storage during the harvesting season is an

essential pre-requisite for implementing a guaranteed purchase price.

It is planned to create 250 ‘polas’, farmer markets island-wide for

farmers to bring their produce to local markets.

UPDGRADING HUMAN CAPITAL

The country’s current education system, particularly the higher

education system, is being recalibrated to produce graduates who will

meet the skill and knowledge requirements of the corporate sector. We

will ensure a culture where job-oriented skill development will take

precedence over the passing of exams, while introducing more real-life

vocational situations and simulations to the curriculum.

INCREASING FEMALE PARTICIPATION IN THE ECONOMY AND GOVERNANCE

The Government is committed to creating good and safe working

conditions through sufficient investments and promoting entrepreneurship

to create quality and high paid jobs in the country while targeting to

increase the female labour force participation rate to 40% by 2020. It

is also acknowledged that female-operated Small and Medium Enterprises

(SMEs) could well cater to the demands of the rising middle class, which

is important to Sri Lanka now given the country’s move towards an upper

middle-income economy. The Act has reserved 25% of representation for

women in local authorities.

RECREATIONAL INFRASTRUCTURE

In addition to the recreational parks developed around the country,

life enrichment projects are underway to introduce recreational spaces

in every province, complete with synthetic athletic tracks and

Olympic-sized swimming pools.

EDUCATION

13 YEARS OF COMPULSORY EDUCATION

A fresh policy initiative for making 13 years of education mandatory is now in place.

A pilot project on providing 13 years of mandatory education will

commence next year. Those who do not pursue higher education after O/Ls

will be trained under an upper Secondary Vocational Education system. We

will recruit teachers and instructors required for this purpose as well

as enhance the additional number of teachers needed to fill the cadre

requirements for the next three years. Our focus will be on ensuring

that there will be no teacher shortages by 2019 and ensure all schools

will have complete cadre. We will bring in a law for providing separate

cadre for every school.

We will also commence school inspectorate to ensure that high quality

levels are maintained in teaching. School boards consisting of parents,

staff and past pupils will work towards maintaining high standards.

We will also commence a pilot programme to provide tablet PCs to all post O/L students.

Development of school infrastructure will be given to those needing to build capacity for new intake of students.

PROMOTION OF PRE-SCHOOLS AND DAY-CARE CENTRES

A five-year programme focusing on early child development (ECD) has

been launched for improvement of systems and quality, to enhance the

overall effectiveness and increase the enrolment of children for ECD

programs. Early childhood development is not only meant for pre-school

education, but includes interrelated segments such as health, nutrition,

psychological condition, child care, probation and protection which are

also essential components that will be considered in ECD.

EMPLOYMENT

In order to overcome the mismatch between skills acquisition and

employment, we plan to empower young people without skills needed for

employment, by providing them with additional training opportunities.

We will pool the services of Government and private sectors and

utilize the Government network of state affiliated training institutions

for this purpose. The accelerated Training and Employment programme

will be a Public Private Partnership. The Government will make funds

available both for training as well as supplementing the income of

trainees in the Private Sector. This scheme will start in 2017 and will

be fully operational in 2018.

HOUSING

The Government plans to construct 500,000 housing units for middle

class and the working class, which will give them house ownership at a

subsidized rate. These will be in the form of successful private-public

partnerships and will be private sector driven. These will be based

around vital nerve centres such as emerging cities, while encouraging

the concept of sustainable urbanization; thereby strengthening the

Government’s socio-economic pursuits and sustainable development goals.

The Budget proposal will include detailed information on these initiatives.

Today, what the economy needs is not more governance but to achieve a

goal of prosperity that can happen via the liberation of the economy.

The first generation of economic reforms introduced in 1978 set the

country free from the ill effects of a closed economy. Today before us

is the challenge of introducing the third generation of economic

reforms. We have the potential to become Asia’s next economic success

story if only we can face those challenges successfully.

A booklet that contains detailed information on the planned economic measures will be made available soon.

Mr. Speaker,

In the past, Sri Lanka has missed many opportunities to achieve truly

viable economic success. We cannot let the opportunity before us slip

once again. That’s why we must be able to comprehend the current global

conditions and make the best use of our strengths, utilizing it

successfully towards emerging an economically robust nation.

All of us may have personal opinions and different political

affiliations but we as a nation must be able to rise above it all, to

come together to take our country forward.

We have the best opportunity for that under the National Government.

We cannot hold the past accountable for not going forward into the

future. There’s no use in shedding tears over the wrong economic

pursuits of the past. Instead, we need to focus on the path forward, on

our ability to compete successfully in a dynamic global market place and

carve out our niche among the prosperous nations of the world.

The future generations will depend on us for choosing the right

economic path. As a nation committed to sustainable development and

success, only then can Sri Lankans become the empowered citizens of an

economically sound nation. (Colombo Telegraph)

PRIME MINISTER’S ECONOMIC STATEMENT IN PARLIAMENT ON 27TH OCTOBER 2016

Home Sri Lanka Think Tank-UK (Main Link)

Tuesday 25 October 2016

Sri Lanka Fiscal Reforms: An Imperative For Sustained Growth

Above 7% growth is needed to sustain the economy

Home Sri Lanka Think Tank-UK (Main Link)

Sustained growth is normally viewed from two different angles today.

One is from the point of environment and depletion of non-renewable

resources. The other is from the point of a country’s ability to sustain

a high economic growth based on technological advancement,

infrastructure and quality of human capital. Economic growth involves

the delivery of an ever increasing high volume of material goods and

services to people.

It requires an economy to transform natural resources into final

goods and services by using a combination of technology, physical

capital and human resources. If the rate of annual expansion of the

volume of goods and services, known as real GDP, is above 7% for a

significantly long period, that economy is hailed as a high growth

achiever on a sustainable basis. There is a reason for using the

benchmark growth rate of 7% as the minimum. This is because GDP will

double roughly in every 10-year period, if growth occurs at 7% annually

at a compound rate. Thus, at this growth rate, within 30 years or in a

single generation, Sri Lanka will be elevated to the rich country club.

The sustainability path so marked at a growth of 7% is interrupted, if

the growth rate becomes volatile and falls below the minimum level for

many years. A country desirous of attaining sustained growth has to take

appropriate policies to avoid this possibility.

Environmental issues should be tackled at global level

Environmental issues and their consequential global as well as local

manifestations eroding the welfare levels of people are in the forefront

of economic policy discussion and global action today. Since it is akin

to the financing and production of a global public good, it needs to be

addressed by consensual global action reinforced by supportive local

policies.

The global community is far away from reaching agreement on such a

consensual action program. Hence, in the meantime, the most pressing

problem faced by emerging economies like Sri Lanka is the elevation of

the respective economies to a high growth path that would eventually

uplift the welfare level of the peoples of those countries. Therefore,

this address will look at how fiscal reforms are imperative for the

attainment of the second aspect of sustainable growth, namely, the

continuous expansion of the material goods and services produced within

an economy.

A volatile growth below 5% on average

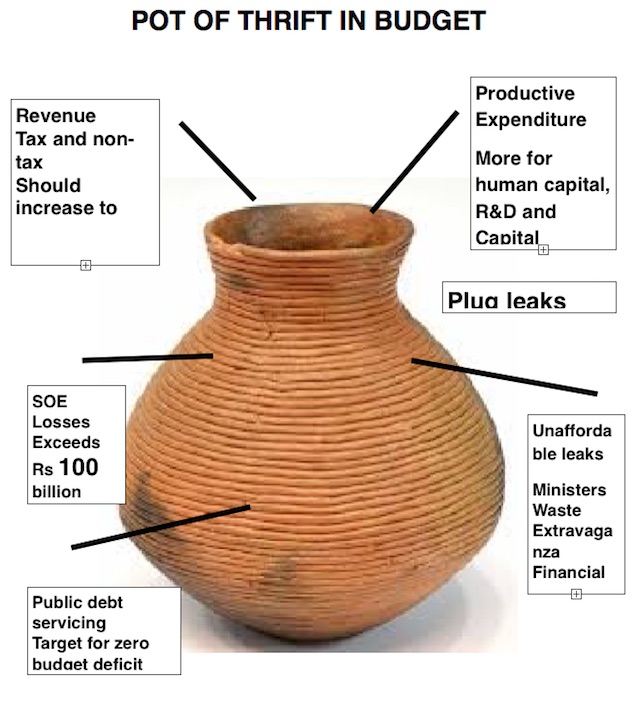

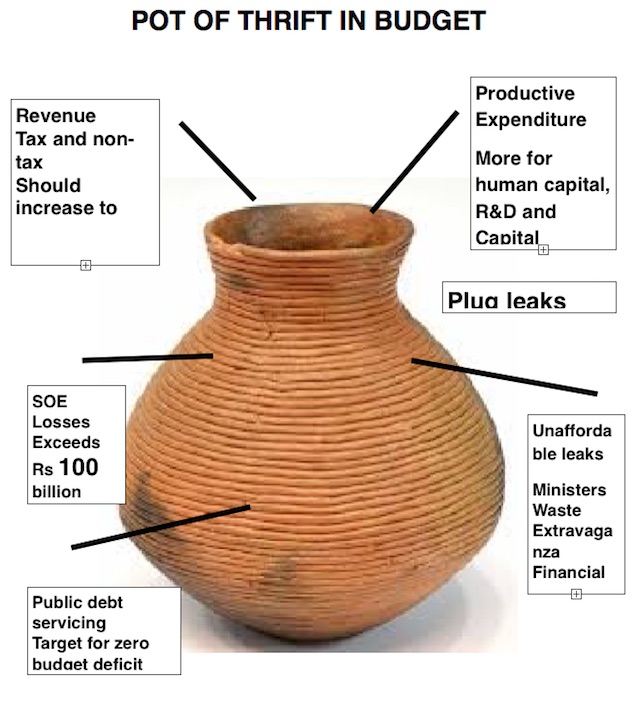

Sri Lanka’s growth numbers show, as presented in the graph, a high

level of volatility since independence. From 1951-2015, the country’s

growth rate has been on average at 4.7%. In this long 65-year period,

spikes representing growth rates of above 7% have been recorded only in

six years. Even then, they are a way apart from each other except for a

brief period during 2010-2012. All others have mostly been troughs below

5%. Thus, Sri Lanka’s material growth has not been a sustainable one

posing the serious challenge of lifting the economy to a continuous high

growth path.

This poor achievement has been made by the country despite the avowed

goal of all the governments to make it a rich country within a single

generation. That goal has been elusive moving away from Sri Lanka every

time it tries to reach it. The problem has become more complicated

as some empirical studies have shown such as the joint study done by

IMF researchers and a local economist that the country’s actual growth

initiatives have been above its potential growth.

The implication is that the growth has been attempted through

expansionary fiscal and monetary policies raising the aggregate demand

above the aggregate supply causing an overheating in the economy.

The outcome has been manifested by above average inflation within the

domestic economy increasing the cost of production and thereby eroding

the country’s competitiveness, on one hand, and putting pressure for the

exchange rate to depreciate against other major currencies, on the

other. Thus, how to generate a sustained growth has been the most

pressing development challenge which the country is facing today.

A bad track record in fiscal policy

Sri Lanka’s past fiscal policy has a very poor track record.

Ministers of Finance come up with budgets with ambitious fiscal targets,

hail their products as ‘development budgets’ and spend more time in

criticising their predecessors instead of proposing strategies for the

future.

Private sector chambers too join Finance Ministers in calling those

budgets development oriented and business friendly just by looking at

the handouts delivered to them. However, there is no mid-term or

year-end review of budgetary achievements, though it is now a

requirement under the Fiscal Management (Responsibility) Act enacted in

2003.

Though these reports are published as required, they seldom conform

to the requirement of presenting analyses of achievements against

targets and why such targets have not been achieved, if they have failed

to attain them. There is no ex post review of the budgetary

achievements against the targets so that the Ministers of Finance could

rectify the mistakes they have made.

Budgeting is a process which requires continuous review,

identification of deviations and making amendments to current strategies

to address those deviations. If this process is not followed, the

fiscal situation of the country begins to deteriorate year after year,

reaching a situation where the country is unable to improve the

conditions without making sacrifices on a massive scale or getting

external support. Today, Sri Lanka’s fiscal situation is exactly in this

condition.

Problems in the fiscal sector

Sri Lanka’s weak government sector is rubbing its inefficiency on all

the sectors in the economy. It is conventional to name the private

sector as the ‘engine of growth’. If so, the engine should have a driver

and that ‘driver’ is none other than the government sector. If the

driver is inefficient and incompetent, the engine cannot move. The

responsibility for making the engine driver efficient and competent

devolves on the fiscal policy. It requires the government to adopt a

host of policies.

First, it has to prune the government sector which has grown beyond

the country’s carrying capacity. Second, it has to decide on its

priorities carefully allocating funds for future growth generating

sectors.

Third, it has to reform the loss making public enterprises so that

they would not be a burden to taxpayers. Fourth, the Government has to

improve its revenue base so that it would be able to finance its

ever-growing expenditure through revenues generated from taxes, profits

and other sources.

Fifth, it has to put a stop to unnecessary expenditure programs that

have become a drain of the scarce resources of the Government. Sixth,

the budget has to be consolidated to reduce the ever-increasing public

debt driving the country to an inescapable debt trap.

Seventh, waste, corruption, and profligacy in expenditure have to be

eliminated promoting thrift at every level. Eighth, the current fiscal

crisis should be recognised, communicated effectively to the electorate,

and the painful measures waiting for the people should be properly

marketed.

Past advice not heeded to

These issues have been discussed, analysed and debated at various

public forums in the past. To its credit, the themes of most of the

previous annual sessions of the Sri Lanka Economic Association had

covered these issues. The Presidential Addresses made by the SLEA

President, Professor A.D.V. de S Indraratne from 2004 to 2014 at those

annual sessions and now released as a book under the title ‘Policy

Issues for Sustained Development in Sri Lanka’ have critically analysed

those issues.

In addition, the Institute of Policy Studies too has analysed these

issues in its annual publication, The State of the Economy, which is

normally released prior to the Budget Speech by the Minister of Finance.

Hence, I will focus in this keynote a few salient issues that need be

addressed urgently.

Heading toward a debt crisis

One issue is Sri Lanka’s high public debt levels that have eaten up

almost the entirety of the Government revenue for servicing the same.

The recorded public debt as a percent of GDP has declined from above

100% in early 2000s to a level of around 72% over the last five-year

period.

Apparently, this shows an improvement but behind this improvement,

there are a lot more to be reckoned with. Sri Lanka’s commercial

external debt is rising, posing problems for future debt sustainability.

A recently made charge in this connection has been that the total

indebtedness of the public sector has not been recorded in the

government debt office which records only the borrowings of the central

government. Thus, it is charged that it has left out a large segment of

borrowings by public sector institutions.

Most of this extra-Treasury debt has been raised on the strength of

guarantees issued by the Government and therefore if the public sector

entities fail to repay, a contingency liability will fall on the

Treasury to honour the same. The problem has been further complicated by

the use of the commercial external debt raised at high costs for

unproductive infrastructure projects without proper cost-benefit

analyses or viable business plans. Hence, the burden of maintaining such

unproductive infrastructure projects as well as servicing such debt has

fallen to the country’s taxpayers.

Loss-making SOEs

Another salient issue has been how the loss-making public enterprises

could be turned around to enable them to contribute to the public

coffers. The leading loss-makers in the past decade have been SriLankan

Airlines, Mihin Air, CEB, CPC, CWE and CTB.

The annual losses of these five public enterprises have been more

than Rs. 100 billion. The implication of such loss-making for the budget

has been that its scarce resources have to be used to keep them going.

Since the annual running cost of a mid-size university is about Rs. 2.5

billion, these loss-makers have forced the nation to sacrifice about 40

mid-size universities.

The Ministry of Finance had emphasised in the past that public

enterprises should deliver an adequate return to the Treasury on the

investments it has made. However, no concrete action was initiated by

the Ministry to force these enterprises to deliver positive returns.

There is an initiative made by the present Government to restructure the

loss-making public enterprises. Yet, the progress has been slow and in

the interim, the Treasury has been forced to fund their losses so that

they could keep their balance sheets clean and continue to borrow from

commercial banks.

One mistake made by the present Government is the decision to

amalgamate two sick persons, SriLankan Airlines and Mihin Air as from

the beginning of November, 2016. Since both are sick, the Treasury will

have to pump money to keep both sick persons going. It will increase the

taxpayers’ liability rather than easing the same.

Friction between monetary and fiscal policies

A third, perhaps very important, issue has been the non-coordination

between the fiscal policy adopted by the Ministry of Finance and the

monetary policy adopted by the Central Bank. Thus, when the Central Bank

tightens monetary policy to fight inflation, the Ministry of Finance

introduces measures which weaken the Central Bank’s action.

A good example was the tightening of the monetary policy by the

Central Bank in July 2016 by increasing its policy rates by half a

percent. The objective of this measure had been to curtail the expansion

of the aggregate demand above the aggregate supply and thereby causing

inflation and bringing pressure for the exchange rate to depreciate.

Almost immediately, the Ministry of Finance announced the granting of

the duty free car importation facility to public servants stimulating

the demand and negating the action taken by the Central Bank.

Unwarranted bailouts

A fourth area of concern is the bailing out of the fraud-stricken

bankrupt financial institutions by using public funds or Central Bank’s

money printing ability.

One example is the money made available by the Treasury amounting to

Rs. 4 billion to pay out to the alleged depositors of the bankrupt

credit card operator, the Golden Key Company.

Neither the Government nor the Central Bank has an obligation to do

so since it is a company that operated illegally as a deposit-taker.

Then, last week, the Central Bank has outdone the Government by making available a sum of Rs. 16.5 billion to bail out a bankrupt primary dealer and three finance companies.

Solving Entrust issue without legal provisions

The primary dealer, Entrust Securities, has reportedly defrauded

investors who have paid that company to buy government securities on

their behalf. The amount involved has been estimated at Rs. 12 billion.

The Bank has proposed to lend Rs. 8 billion to a Special Purpose Vehicle

managed by Seylan Bank to enable the manager to accumulate interest for

eight years by investing the same in a government security and pay the

investors out of the interest income so earned.

SPV is required to return the original Rs. 8 billion to the Bank at

the end of the eight-year period. This lending is against the Monetary

Law Act or MLA which has authorised the Monetary Board to lend only to

commercial banks and NSB for meeting liquidity shortfalls against the

collateral of prescribed securities, only for a period at the maximum of

nine months. This restriction has been introduced to prevent the Board

from lending to others causing inflation, on the one hand, and leading

to frauds, on the other.

Hence, the Board is exposed to possible criminal liability charges in

the future. In this scenario, it is advisable that the Monetary Board

re-examine this proposal before its implementation.

Opening Pandora’s Box

The three finance companies involved have been Standard Credit

Finance, City Finance Corporation and the Central Investment and

Finance. The Bank is expected to make out these payments out of its

deposit insurance fund or DIF which has sufficient resources at present.

But given the liability which will fall on it on account of other sick

financial institutions, it is questionable whether this measure adopted

by the Board is prudent.

Further, the Bank has opened Pandora’s Box by using its money

printing machinery and funds in DIF to bail them out since it creates a

bad precedent for future would-be-defaulting financial institutions. It

appears that its implication on the Budget has not been properly

assessed by the Ministry of Finance. These bailouts reduce the Central

Bank’s transferrable profits to the Government which the Budget 2016 had

estimated at Rs. 13 billion in each of the years from 2016-2019. Since

the Central Bank had made losses in 2015, it could not deliver the

amount earmarked for 2016. A similar fate might befall the Treasury in

2017 and beyond in view of these imprudent bailouts. Hence, in the final

analysis, both these liabilities will fall on the Budget.

Fiscal reforms a must

Thus, it is necessary that the government sector should be reformed

in order to facilitate it to allow the private sector to function as the

engine of growth. An essential element in the reform of the government

sector is the reform of the fiscal sector to enable the Government to

allocate more resources for production rather than for consumption. In

this case, a prudent use of scarce resources under the Government’s

fiscal reforms is a must. (W.A. Wijewardena)

Home Sri Lanka Think Tank-UK (Main Link)

Wednesday 14 September 2016

Subscribe to:

Posts (Atom)